“Open platform in private banking: further developments” – B&F

Open platform in private banking: further developments

By Edgar Brandt & Christian Mustad

By Edgar Brandt & Christian Mustad

Edgar Brandt Advisory SA*

____________________________________________________________________________________

*Edgar Brandt Advisory SA is a professional service firm that serves companies and private equity investors.

The company has been founded by the former head of Andersen Business Consulting in Switzerland. Its core team has proved its worth over the years within the demanding environment of top notch international consulting and audit firms.

With decades of combined track record and several hundreds of engagements focused on clients’ needs, the team has gathered valuable experience in a wide range of industries internationally. Solid expertise in strategy, organization and finance allows the company to deliver tangible results of the highest relevance to its clients.

For investors in private companies, the team has developed a range of services that allows its clients to secure the level of support they require along the different phases of their investment process, from pre-selection to due diligence to post-acquisition monitoring.

www.eb-advisory.com

____________________________________________________________________________________

Private banks have seen their operating model modified in recent years through the advent of open platform, most notably through the hedge funds phenomenon. Banks are now, more than ever before, integrators of a variety of skills rather than providers of services solely developed in-house. The growing importance of private equity as an asset class may well provide the next phase in this evolution.

Origins

Structural changes in any industry appear to happen relatively suddenly to casual observers. Mostly however, these structural changes happen at the confluent of trends that simultaneously reach maturity.

Possibly the most important structural change impacting the private banking industry in recent years, “open platform” has fundamentally altered the way banks interact with other players in and around their industry, and the way they promote their value added to the market.

Among a variety of evolutions in the environment surrounding banks, two main trends have most contributed to bringing about the era of open platform: Derivatives and the internet.

Even though open platform – as a broad and general approach to private banking – is just a few years old, the internet and especially derivatives have been around for much longer.

The internet phenomenon can be traced back to the early 1960’s, when the US military commissioned the Rand Corporation to study how it could maintain its command and control over its missiles and bombers, after a nuclear attack. As to the development of what was to become the now famous TCP/IP protocol, it began as early in 1973. The use of the Internet exploded after 1990, at least a decade before the advent of open platform as a significant phenomenon.

Beyond the technological aspects of the internet, it is its impact on the structure of the economy that has been the most striking about the internet. It has been broadly accepted since the end of the 19th century that the size of companies, what is in-sourced and what is out-sourced, is determined by transaction costs. The key impact of the internet is to lower overall transaction costs, and this has brought about changes, and still is bringing about changes, of significant magnitude throughout the world economy.

For the banking industry as for others, this has meant taking a hard look at what was considered to be its own, internal, value chain and assessing what was really central to its value added and what could be best handed over to suppliers now able to seamlessly provide services that allowed the bank to focus more on its core business. As a consequence, many banks now outsource activities in the area of information technology, operations, and front office tasks such as research and analysis.

As for derivatives, this type of financial instruments can be traced back to the 6th century B.C., when in it is said that Thales the Milesian purchased what amounts to options on olive presses and made a fortune off a bumper crop of olives. The famous Dutch tulip bulb mania of the 17th century was characterized by forward contracting on tulip bulbs. The creation of the Chicago Board of Trade in 1848 was the next major event in the history of futures market as it allowed a major sector of the US economy to use financial instruments to lock in the price before delivery, therefore reducing volatility. But it is 1973 that is the key date. That year, the Chicago Board Options Exchange was created, and the most famous formula in finance was first published. The options pricing model of Fisher Black and Myron Scholes. The Black-Scholes model ushered in an explosive revolution in the use of derivatives.

The explosive growth of derivatives in turn created a whole new field of related instruments, skills and individuals that proved too varied to be efficiently managed internally by all banking institutions. This situation created the conditions for the advent of the hedge fund phenomenon. There are now somewhere around 10’000 hedge funds in the world. Each of them encapsulates a specific set of skills, a track record and an investment process and philosophy that is sets them apart from the others. They thus provide a neat way for banks to pick and choose, and compose an offering that is itself unique to its customers. In essence hedge funds allow banks to better manage the complexity in financial instruments introduced by the spectacular growth of derivatives.

From traditionally integrated entities, banks have thus undergone a significant transformation to become integrators of a great variety of entities that provide them with some important bits of their overall value chain. In doing so, they have had to develop skills to find, select, and manage relationships with the providers that best suit them, and to ensure that the whole works seamlessly.

The private equity boom and its consequences

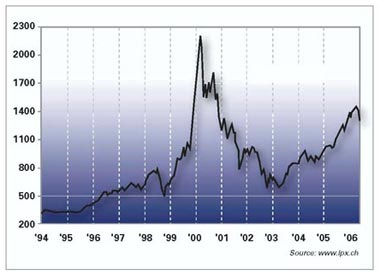

There are other maturing trends around the corner that promise to have an impact on how banks conduct business. One of those is Private Equity. Like derivatives, it has been around for a very long time, but it is now, in its present form, gathering a momentum that brings it to maturity beyond the United States to other regions of the world. The index tracking the progress of private equity globally, known as LPX 50, has added 40% over the last year. As the chart below shows, the trend is unmistakable, even though one must dismiss the effects of the internet bubble, visible with around the peak in 2000.

There are other maturing trends around the corner that promise to have an impact on how banks conduct business. One of those is Private Equity. Like derivatives, it has been around for a very long time, but it is now, in its present form, gathering a momentum that brings it to maturity beyond the United States to other regions of the world. The index tracking the progress of private equity globally, known as LPX 50, has added 40% over the last year. As the chart below shows, the trend is unmistakable, even though one must dismiss the effects of the internet bubble, visible with around the peak in 2000.

As far as Europe is concerned, the European Private Equity & Venture Capital Association (EVCA) estimates that the private equity sector has raised EUR 60 billions in 2005, and a recent study conducted by Citigroup suggests that in Europe today, private equity funds have a “purchasing power” of about EUR 184 billions, representing 6.6% of the value of all listed companies in Europe.

So as financial markets all over the world continue to be rocked by uncertainties, and European markets no longer exhibit P/E ratios much different from their US counterparts, investors increasingly look to private equity investments to provide an antidote to the turbulences of stock markets.

This increasingly important asset class presents the banks with yet another challenge. This challenge is not completely new, though. Universal banks, traditionally heavily involved with the private (ie. non-quoted) companies that form the industrial basis of all developed economies, have steered away from them over the last two decades and put more emphasis on other types of activities. Private companies were considered to be too risky and not profitable enough.

But with private equity reaching maturity, the business of investing in private companies will increasingly face the same challenges faced by universal banks. Experts in the field say nothing else when they assert that traditional methods used by private equity funds to create value when buying up private companies – “buying low”, consolidation strategies and financial engineering – are no longer enough in an increasingly mature and competitive environment. As more and more companies are financed by private equity funds, the average profile of these companies is increasingly similar to that of any other company.

Major strategy consulting firms have researched the issue of ownership principles that can best drive performance, and they have found that those investors that have a more proactive approach towards the companies they invest in achieve better results. What’s more, industry experts now say that in this new environment, success will increasingly depend on the ability of those who invest in private companies to “dig deep” in their operations and deliver improved operational performance.

An additional component to the architecture

If today’s investors in private equity want to avoid the disappointment of universal banks with private companies, they will have to ensure that their investments are actively nurtured by professionals that have the skills to devise and implement the measures that will improve all the relevant aspects of a company’s operational performance.

That sort of skill is not one that is traditionally found in banks, and it is fair to say that with the growth of recent years, it is in very short supply within the private equity industry. The private equity sector is thus faced with two related challenges. The current growth of business is, ceteris paribus, stretching the players thin in terms resources to cope with ever increasing assets under management, and the market conditions will force a thorough rethink of strategies and require a more extensive skill base.

So just as what we might call the first incarnation of the open platform model allowed banks to have access to an unprecedented diversity of skills and know-how in the field of alternative investment strategies, chances are that the strong development witnessed today in private equity will drive the banking industry towards further opening up to a world of complementary competencies and services.

The skill set that will be in increasing demand is that of “business management”, or more specifically the ability to define the right strategy for a company and, crucially, to make that strategy happen.

The difficulty attached to actually delivering on a strategy is not always fully appreciated by the financial community, yet business papers around the world are full of stories about ambitious company projects – mergers, acquisitions, strategic shifts, etc. – that end up in tears. It is worth remembering that statistics on the success rate of mergers and post acquisitions integration is dismal. Initial plans were applauded, the management team in charge recognized as highly capable, but the whole exercise ended up destroying rather than creating value…A story that sounds familiar.

The owners of a private company will always be willing – or forced – to accept to open the capital of their company at a turning point in the company’s history: A change of generation at the top, a change of strategy that requires significant investment, management deciding to buy up the company, etc. Private equity investment will therefore never be “steady-as-she-goes” investments (if there is such a thing); they will be characterized by significant uncertainties, and the need to successfully implement important changes within the company.

The rather vague term – “business management” – used above to define what skills will be needed to face these news challenges needs to be articulated. The competencies that those in charge of securing better returns on investors’ stake in private can be summarized as follows:

First, they will have to be able, beyond proper valuation of a target company and sound definition of its strategic objectives, to critically assess its strengths and weaknesses in terms of its ability to execute the strategy. This requires a good understanding of elemts such as internal communication and follow up mechanisms, company culture, change history of the company, etc.

Second, they will have to have a proven track record in converting strategic objectives that are typically long on desired outcomes and short on practical steps to get there, into a coherent set of initiatives and action plans that are pragmatic, concrete, efficient, and that allow a transparent monitoring of the company’s progress towards its goals.

Third, it will be required from them to get involved at the level of operational processes of the company, firstly in order to anticipate or react appropriately to the unavoidable blockages and bottlenecks that invariably threaten to stop in its tracks the implementation of the most brilliantly thought through plans, and secondly to be able to detect the “productivity pits” that will be the key to enhanced operational performance.

Individuals and teams possessing the competencies described above, and thus fully able of taking on these challenges exist, and are today either already active in the private equity industry or in sectors closely related to it in terms of the competencies they require from their participants. As was the case with the emergence of derivatives, the question is thus not whether the competencies required to fill the gap exist, but how they will integrate into the new environment of the private equity industry.

Evolving structures

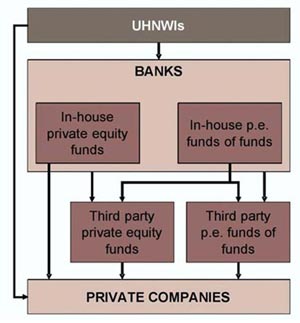

In order to understand how this integration might happen, one need to consider how banks, and their clients, invest in private companies. Banks invest in private equity on behalf of their clients in several different ways. First, through their own, in-house, private equity funds, or funds of funds. Second, through alliances with third party funds.

In addition, banks may support their ultra high net worth clients when these hold direct investment in private companies.

This variety of scenarios is depicted in the illustration below.

The first and obvious way is that Private equity funds will hire additional headcount to take charge of the increasing volume of their activities. Although this solution is obvious, it also has a potential drawback. It has been said above that the issue is not only one of volume, but also one of changing requirements on those managing private equity investments. There will be those investment managers who understand and are willing and able to adapt to a more challenging path to outstanding performance. But we know that many private equity funds already perform rather poorly, and indeed that only a few consistently reach the famed returns associated to this industry. So the drawback is many funds will stick to their usual way of conducting business.

The other main way to integrate this new skill set involves banks continuing on the path they opened with the first incarnation of open platform. As the overall share of assets under management taken by private equity type of investments grows, banks intent on achieving a bigger measure of control on this asset class will come to require more of the competencies described above.

The most probable scenario in this case is a repeat of what happened with derivatives. When faced with a development introducing additional complexity in their “business model”, banks recognized the need to keep focusing on their core business, that of responding to their clients needs, and took full advantage of the emerging hedge funds industry.

We may thus see in the near future a whole series of new, independent players, delivering “shareholdings management” services – or some other name along these lines – to banks increasingly becoming integrators of several types of competencies.

One may imagine these services being delivered on the basis of framework agreements covering whole funds overtime and involving ongoing monitoring of companies in which the fund has invested, from acquisition to exit. These types of services will also probably be delivered as targeted one-off interventions, mainly aimed at ensuring that the plans that have been devised to create value are actually being implemented within portfolio companies, and that the investment is still on track to creating value for investors.

Interestingly, one may also see banks go further in their role as integrator and comprehensive service provider to their clients and propose such services to them. UHNWIs already often have direct holdings in private companies beside their own, family business. This is bound to become even more prevalent as the private equity industry grows ever bigger. Opening a new avenue to improve clients’ satisfaction by providing them with an even more comprehensive set of services certainly constitutes a good business decision in an increasingly competitive environment for banks.

The views expressed here – banks becoming ever more integrators of competencies, the evolution in skill set within the private equity industry, the emergence of new players between private equity funds and banks – are only predictions, of course. They are however based on the convergence of several major trends. Things are moving fast in the banking industry of late, so the next few years will be enough to test the predictions!